If you would like to know more about Clever Accounts, please contact us on 0113 518 8800

A fixed, no committment monthly fee perfect for when you're just starting out in business

A fixed, no commitment monthly fee perfect for contractors, freelancers and limited companies:-

A fixed, no commitment monthly fee perfect for contractors, freelancers and limited companies:-

Dedicated accountant - pro-active support.

Salary, drawings and dividend planning.

Year end accounts, tax returns and VAT returns, all completed and submitted.

Self-assessment tax return completion for all income sources.

Payroll processing for directors and staff.

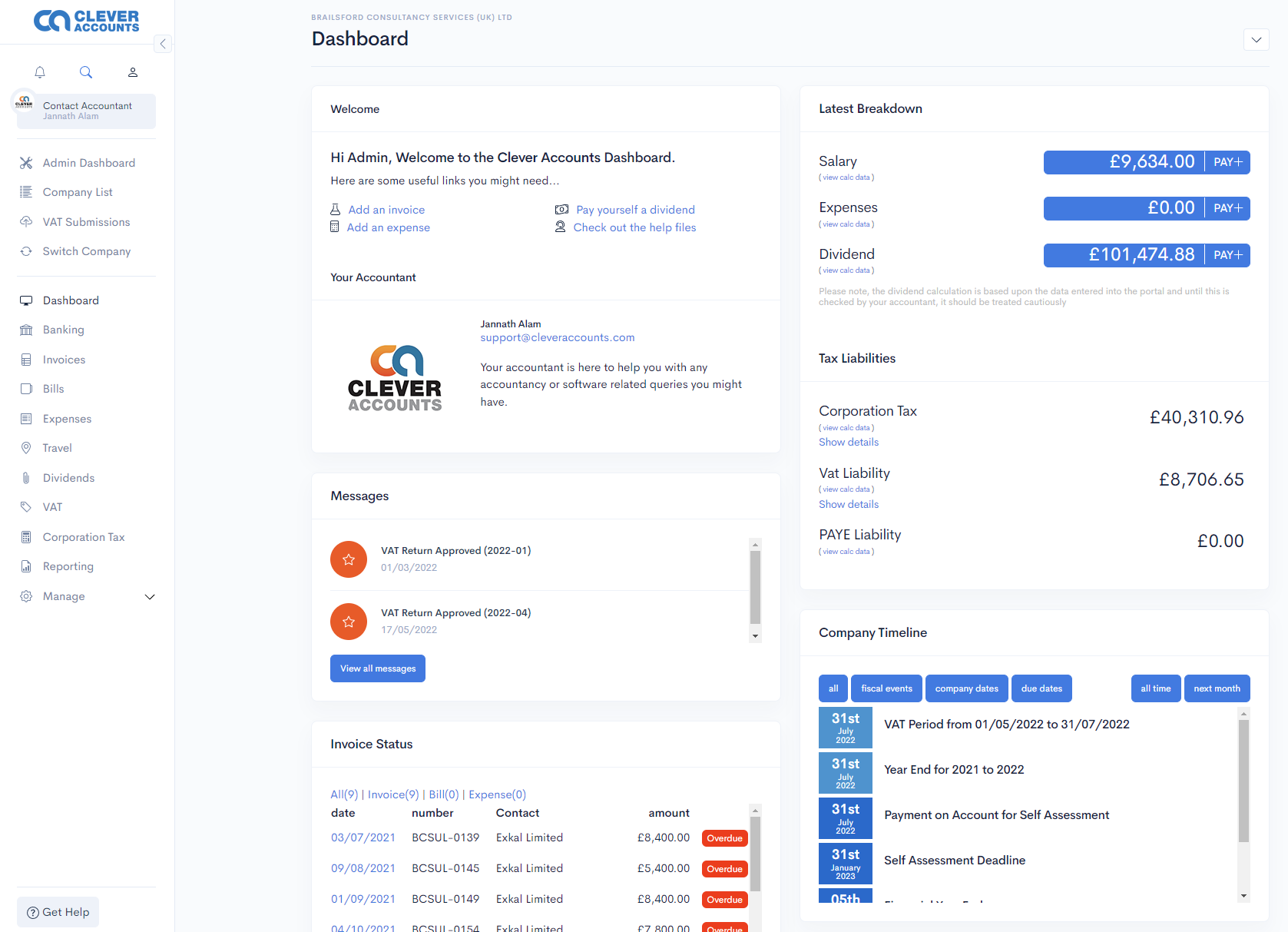

Free, market-leading software from Freeagent.

Send invoices and get paid faster.

Record and track expenses and mileage.

Open banking with more than 25+ banks.

Dashboards with tax and salary overview.

At Clever Accounts, we combine the power of one of the UK's best and most poswerful accounting software solutions with a second-to-none accounting service, backed up by your own dedicated accountant.

At Clever Accounts, we pride ourselves in providing outstanding services to all our clients.

Accountancy isn’t all about crunching numbers and submitting documents but, just like any other online service, we strive to ensure we fully understand your needs as a customer and we communicate to you in a friendly, clear and concise manner.

No matter your industry and accounting needs, we have an accountant that is experienced to help you run your business and allow you to focus on growing your business.

We understand your time is valuable, so we strive to ensure our modern, software-driven systems provides you a hassle-free, seamless experience with us.

Our online accounting app is easy to use and will be a perfect financial companion for any type of business you have.